Advertisement

Question 11 Chapter 4 – Class 12 Part 1 Unimax

11. The following is the Balance Sheet of P, Q, R and S as at 31st December, 2020.

| Liabilities | Amount | Assets | Amount | |

| Creditors | 80,000 | Bills Receivable | 20,000 | |

| Reserves | 1,50,000 | Building | 6,50,000 | |

| Profit & Loss A/c (Profits) | 90,000 | Plant & Machinery | 500000 | |

| Capitals : | Stock | 3,00,000 | ||

| P | 2,00,000 | Debtors | 2,40,000 | |

| Q | 3,00,000 | Cash at Bank | 10,000 | |

| R | 5,00,000 | |||

| S | 4,00,000 | 14,00,000 | ||

| 17,20,000 | 17,20,000 |

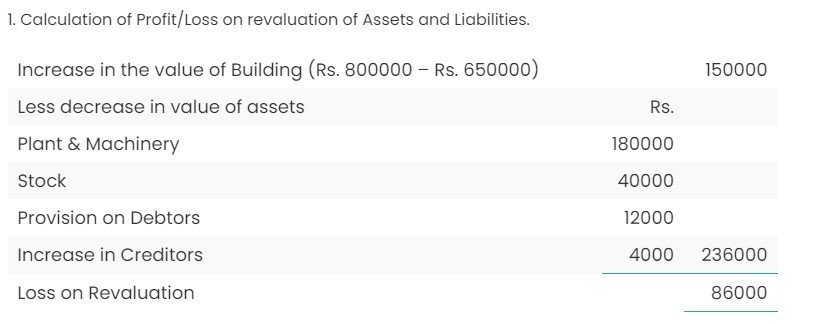

On 1st January, 2021 the assets and liabilities were revalued as under :

| Building | Rs. 8,00,000 |

| Plant and Machinery | Rs. 3,20,000 |

| Stock | Rs. 2,60,000 |

| Creditors | Rs. 84,000 |

A provision of 5% was required on debtors. Goodwill of the firm is valued at Rs. 1,70,000. Partners agreed that from 1.1.2021 they will share profits in ratio of 4 : 3 : 2 : 1 instead of their former ratio of 5 : 4 : 2 : 1. They don’t want to record revised values of assets and liabilities in the books. They also don’t want to distribute the reserve and P & L A/cs balance.

Pass a single Journal entry to give effect to above.

The solution of Question 11 Chapter 4 -Class 12 Part 1 Unimax:

Journal

Working Note :

Calculation of Sacrifices/ Gains to Partners

Credits to be given to Partners

P : (Rs. 324000 X 1/60) = Rs. 5400

Q : (Rs. 324000 X 2/60) = Rs. 10800

And Capital accounts of R & S should be debited with following Amounts

R : (Rs. 324000 X 2/60) = Rs. 10800

S : (Rs. 324000 X 1/60) = Rs. 5400

Advertisement

Advertisement